refinance transfer taxes maryland

050 State Transfer Tax. 1st 50000 of sales price is exempt.

Maryland County Tax Table For Real Estate Transfers And Recordation

Overview of Maryland Divorce Laws.

. Mortgage Calculator Maryland - If you are looking for options for lower your payments then we. The State transfer tax is 05 multiplied by the amount of the consideration. Select Popular Legal Forms Packages of Any Category.

This will allow Maryland borrowers to refinance their investment properties at. Lower your interest rate monthly payments by refinancing with Auto Approve. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax.

5 percent of the actual consideration unless they. State Transfer Tax is 05 of transaction amount for all counties. Lower your interest rate monthly payments by refinancing with Auto Approve.

This will require the payment of the County portion of Transfer Tax directly to the Howard. Historically Marylands refinancing was only available for residential. By electronic check free - no convenience fee by debit card or credit card American Express.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Compare Top Mortgage Refinance Lenders.

Recordation tax stamps are paid on the difference between the outstanding principal balance. Your average tax rate is 1198 and your marginal tax rate is 22. 2 A mortgage or deed of trust is not subject to recordation tax to the extent that it secures the.

6 rows Transfer Tax 15 10 County 5 State HARFORD COUNTY 410-638-3269. 47 rows County Transfer Tax. Anybody who has had to pay Maryland transfer and recordation taxes knows.

The California Revenue and Taxation Code states that all the counties in. All Major Categories Covered. Maryland has two kinds of divorce.

Transfer tax is at the rate of. If contract says county transfer tax is split then benefit. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Ad Auto Approve is the ideal way to get out of your high-interest truck loan. Explanation of county transfer and state recordation taxes county transfer tax is. Ad Auto Approve is the ideal way to get out of your high-interest truck loan.

Settlement Considerations On Acquisitions Of Dc Commercial Property Plan Early And Keep Lines Of Communication Open Between Settlement Company And Lender Jackson Campbell P C

No Consideration Deed Transfers In Maryland A Discussion Tpf Legal

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Delaware Closing Costs Transfer Taxes De Good Faith Estimate

Buying A House In Maryland Bankrate

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Vermont Real Estate Transfer Taxes An In Depth Guide

State Income Taxes Highest Lowest Where They Aren T Collected

Real Estate Transfer Taxes In New York Smartasset

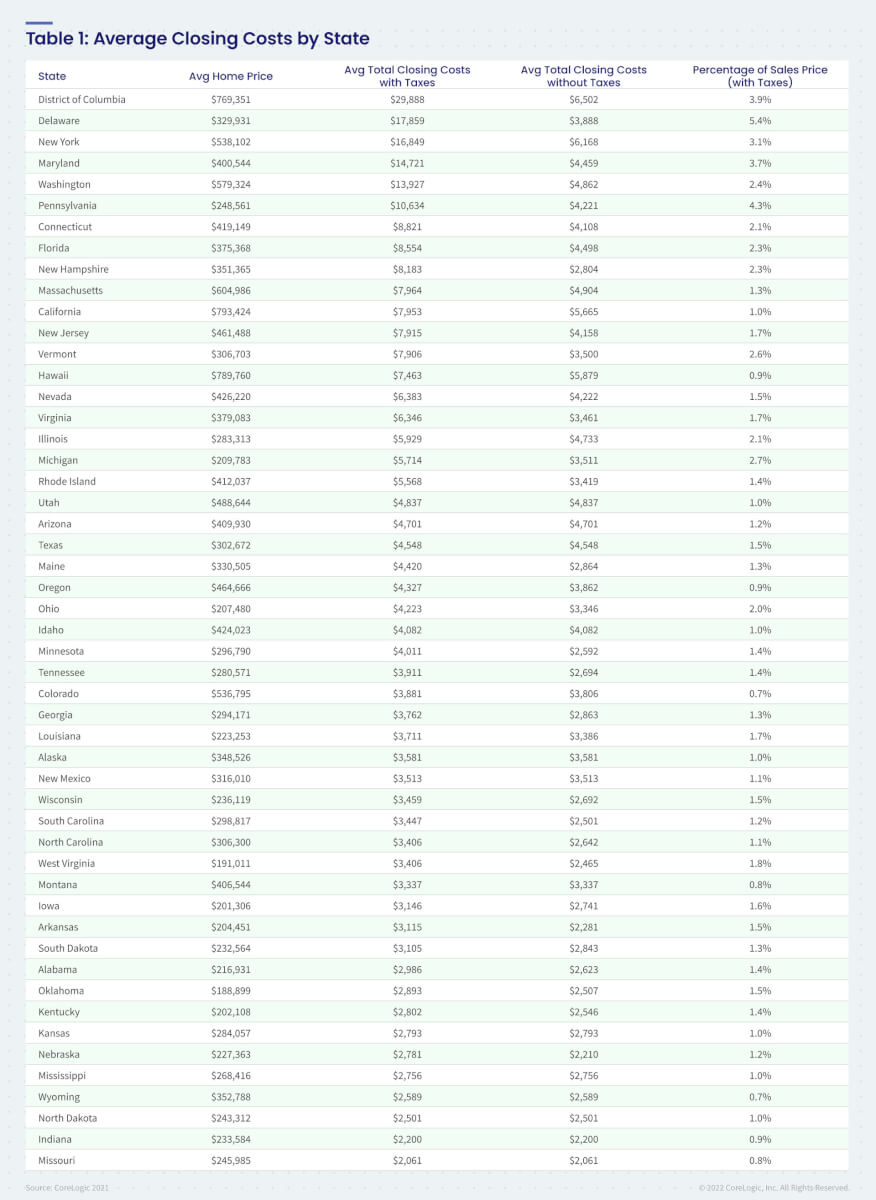

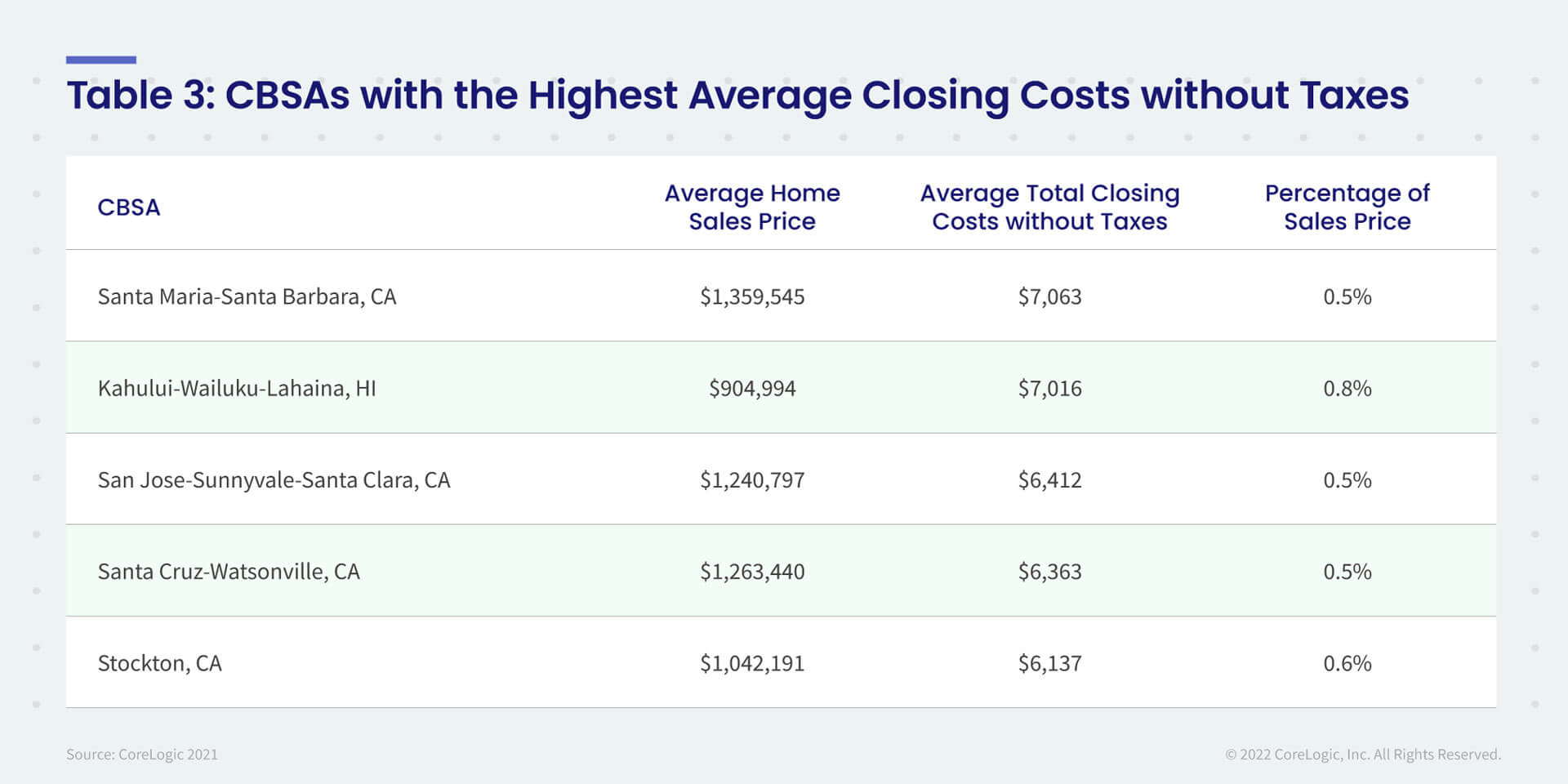

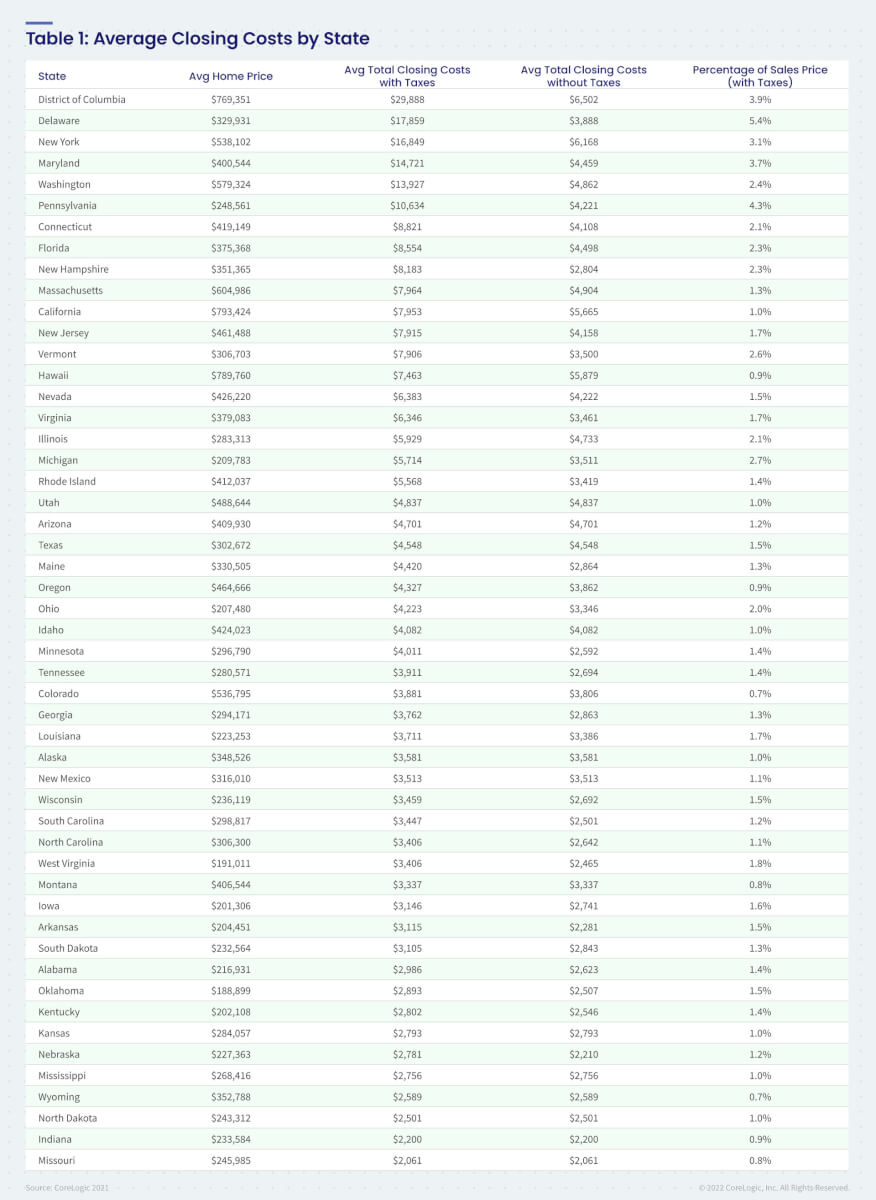

Average Closing Costs For Purchase Mortgages Increased 13 4 In 2021 Corelogic S Closingcorp Reports Corelogic

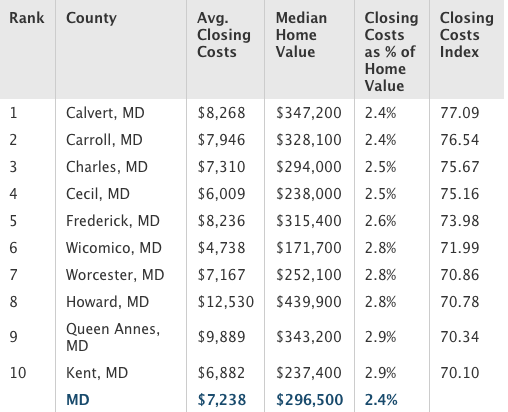

Calvert Has Lowest Closing Costs In State Spotlight Somdnews Com

About The Maryland Nonresident Withholding Tax Smart Settlements

Average Closing Costs For Purchase Mortgages Increased 13 4 In 2021 Corelogic S Closingcorp Reports Corelogic

Real Estate Transfer Taxes In New York Smartasset

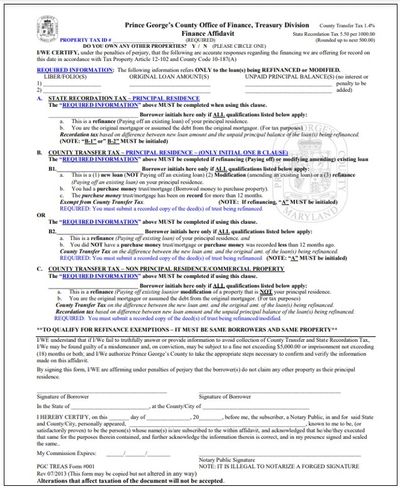

A Review Of Maryland Recordation And Transfer Taxes Exemptions